Dear Dave,

My husband and I are in a bad situation, and we’re thinking about taking my parents up on their offer to move in with them. We both work two jobs. I’m a medical transcriptionist with a small business on the side, and he’s a warehouse clerk who is also trying to get a business off the ground. Combined, we bring home about $70,000 a year, plus we have $80,000 in debt between credit cards and a car loan. On top of all this, our rent went up 18% at the first of the year, and we can’t afford the increase. Should we move in with my folks?

Melissa

Dear Melissa,

I’m not opposed to families jumping into a situation together to solve a problem. That includes grown children moving back home for a short period of time. Sometimes, when the right people are involved (and proper boundary expectations are established and agreed upon), it can work out well for everyone. I just want you to be very careful that you’re not using a move like this to mask the real problem.

I’m going to shoot straight with you. The real problem isn’t an 18% jump in rent. The real problem is what that rent increase revealed about you both—the fact that you have weak careers. You guys are like two hamsters in a wheel right now. Neither one of you is afraid of work. That much is obvious. And you’re working four jobs between the two of you, so there’s no lack of effort. But you’re not gaining any traction. You’re not making a lot of money, and the debt hanging over your heads isn’t helping either.

Your parents are obviously good-hearted people, Melissa. If you do this, I want you, your husband and your folks to go into it with this mindset—your stay with them is a brief stopover on your way to prosperity. Don’t go into this—any of you—with an attitude of the world is mean, rent went up, and we can’t make it out there. This is a safety net, not a hammock. Use this time to begin addressing your financial issues, and take a long, hard look at your career and income situation. If you use this opportunity wisely, you can emerge in a better place with your money and with getting ahead in your careers.

God bless you all!

— Dave

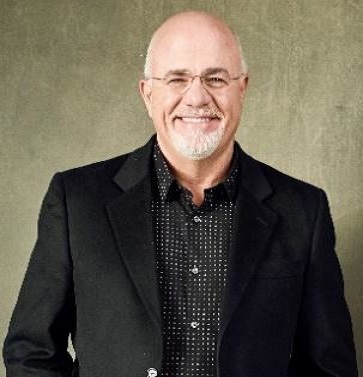

Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show, the second-largest syndicated talk radio show in America. He has appeared on Good Morning America, CBS Mornings, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions.

.jpg)