Dear Dave,

I’m 32 and a teacher. My house is my only debt, and there’s $55,000 left on my mortgage. My parents always taught my brother and I about saving and being smart with money. The other day, mom and dad offered to pay off the rest of my mortgage by loaning me the money with a very small interest rate. I know you don’t like the idea of mixing money and family, but considering I have a great relationship with my parents, what do you think about this offer?

Lacy

Dear Lacy,

I’m going to make a suggestion before saying don’t do this. See what I did there?

But seriously, I’d recommend they just make the money a gift and reduce your portion of any later inheritance by that amount. By doing this, you could help reduce the possibility of your brother feeling slighted in any way.

I would never loan my kids money. And here’s why: One hundred percent of the time, the Bible says the borrower is slave to the lender. That doesn’t exempt parents and their kids. No matter how nice your masters are, you’re still a slave in this kind of situation—and you’ll feel it. Family dinners and get-togethers are different when you’re sitting down to eat with your masters—your creditors—instead of just good ol’ Mom and Dad.

Don’t get me wrong, I’m not suggesting you should act ungrateful that they offered a loan instead of a gift. It’s a generous thing either way. But if they don’t want to go the gift route, that’s fine. You have a good job, a nice home, and you’ll be okay. The thing is, I just wouldn’t want to take a chance on straining a great relationship—or even ruining it—because of money.

Lacy, you’re 32, a teacher and a homeowner. In my mind that says a lot about you, your maturity and your work ethic. That being the case, I get how this could be a weird thing for you to do. So, I’m going to give you an out: Blame me. Just tell them you talked to me, and I said don’t do the loan idea. Tell them I gave you the make-it-a-gift-tied-to-the-inheritance idea.

If your mom or dad wants to talk to me about things, that’s fine. I’ll be kind to them. But I’ll tell the truth like I always do.

— Dave

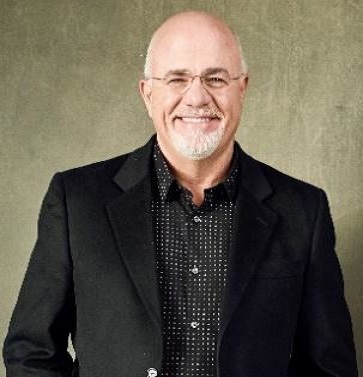

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of “The Ramsey Show,” heard by more than 18 million listeners. He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions.

.jpg)