Dear Dave,

My mother died about a year and a half ago, and she left me and my younger sister $75,000 each. My sister is 16, and she plans on enlisting in the military after high school, then using the G.I. Bill to pay for college afterward. She won’t receive the inheritance money until she’s 18. What advice can I give her to ensure she makes good decisions with the money?

Davis

Dear Davis,

I’m truly sorry to hear about your mom. At the same time, I’m so proud of you for stepping up to help your little sister. You know, $75,000 sounds like a lot of money—especially to a teenager. But that kind of cash can disappear in a heartbeat if she’s not careful. And then, all she’d have left where her inheritance is concerned is a lifetime of regret.

If she’ll be smart with this money, and by that, I mean investing wisely and having a little bit of fun, she could end up a rich, little old lady one day. Not only that, but she can honor the memory of your mother and change her family tree forever. Her family will think differently, and be able to live differently, all because she had the maturity to not blow the money.

You said she’ll get $75,000, right? Think about this. She could just have fun with $15,000 or so, and invest the rest in good, growth stock mutual funds. If the stock market continues to average what it has since its start, she’ll be a multi-millionaire—and then some—by retirement. Even if I’m half-wrong on the math, the advice still stands. She’d have millions waiting for her. The point is that investing a big lump sum of money, and leaving it there for her golden years, is a great idea.

Now, I’m going to give you some homework, Davis. I want you to talk to a bunch of rich, old folks. Learn what they did to build wealth and hang onto it. Also, make sure the friends and family you both have around you are quality people—the kind who have your best interests at heart. Remember, the Bible says, “In the multitude of counsel there is safety.”

Your sister is very lucky to have a big brother like you. Walk her through this advice. Be there for her. Look out for her. She needs you right now, and she’ll need you in the years to come.

God bless you both!

—Dave

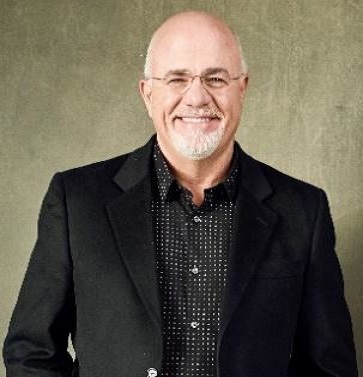

*Dave Ramsey is an eight-time No. 1 national best-selling author, personal finance expert and host of The Ramsey Show, heard by more than 20 million listeners each week. He has appeared on Good Morning America, CBS Mornings, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for the company, Ramsey Solutions.

.jpg)