Dear Dave,

I switched to a debit card so that the money I spend comes directly from my checking account. But I still have a problem some months with overspending and buying things I shouldn’t. Do you think I should stop using my debit card?

Debbie

Dear Debbie,

When I made the decision to get intentional with my money, I just used cash. It’s hard to spend it when you don’t have any on you. It’s a tough thing, I know, but you have to make a conscious decision to start living differently. You’ve got to get mad at the things that steal your money a dollar or two at a time enough to take action.

Try looking at your life as a whole, not a moment at time. All the moments you’re living right now will have either a positive or negative effect on your future. I decided I wanted the greater, long-term good, so I gave up on the short-term stuff.

Debit cards are great tools. You can’t spend money you don’t have with them like you can with a credit card. But you’ve still got to budget very carefully for each month, and give a name and a job to every single penny of your income. Otherwise, you can still overspend.

—Dave

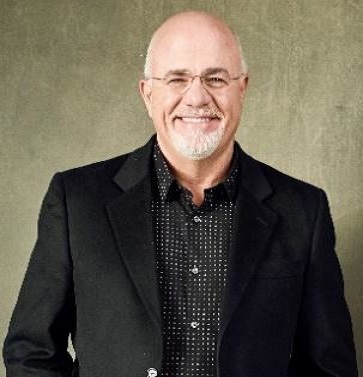

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)