Dear Dave,

My wife and I have been married for nine months, and we’ve been following your Baby Steps plan for three months. We have about $50,000 in debt, and I recently cashed out an old whole life policy that enabled us to pay off $22,000 of our debt. My wife still feels weird about us doing that, since the money paid off all the student loan debt she accumulated before we got married but none of the debt I brought to the marriage. I look at everything as ours, not mine and hers. What can I do about her sense of guilt and feeling indebted to me?

Anonymous

Dear Anonymous,

This isn’t an uncommon thing in situations like yours. But more than feeling indebted to someone or experiencing a sense of guilt or shame, it’s really a discussion about differing views of marriage.

You’re never in debt to your spouse. You should be all in where your husband or wife is concerned. Remember the vows? For richer, for poorer. In sickness and in health. If she makes you chicken soup when you’re sick, does she charge you for it? Of course not. When you get married, you agree to take on each other’s burdens. Once you walk down the aisle with someone, you’re choosing to serve each other. You’re also choosing to take on each other’s debt, each other’s income, each other’s assets and each other’s crazy parents. Everything!

It all boils down to having a shared view of a proper marriage relationship. And the proper (and biblical) view is we own everything. There’s no mine and yours anymore. Now, you can’t make her feel—or not feel—a certain way. But you can ask her questions to understand where she’s coming from and what blockers are keeping her from being totally together in this. Talk about it. Put your heads together and practice thinking about your marriage as a union.

It will take some encouragement from you and some getting used to on her part, but if you work together, it’s a muscle you can grow and develop together!

—Dave

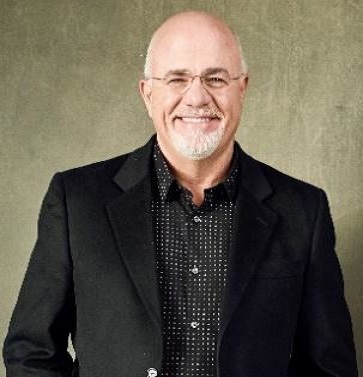

Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions.

.jpg)