Dear Dave,

We are ready to start Baby Step 2, and we have about $35,000 in total debt. Our two smallest debts, a credit card and a truck we financed, are both $4,500 right now, and we have a combined income of about $95,000 a year. Since the credit card has a higher interest rate, my wife thinks we should pay it off first. To me, the truck is a necessity, and we should pay it off first for that reason. What do you say?

Grant

Dear Grant,

When the rule of paying off debts from smallest to largest doesn’t apply, I think you should attack the one with the larger interest rate first. In your case, that’d be the credit card debt.

I get what you’re saying about the truck. And I agree that transportation is a necessity. You guys might be in a bind if something happened and you lost a vehicle, but it’s also a situation you could probably work around for a little while if you had no choice. My guess is you have friends or relatives who could loan you a car in a pinch, and public transportation is an option for some folks. So yeah, knock out the credit card first, then move on to the truck.

Do you understand my reasoning, Grant? Going this route serves two purposes: First, it will save you a little money. And second, I’ve got a feeling it will fire up your wife, and get her on board with the idea of you two getting your finances in order even more than she already is.

She’s taking this whole thing pretty seriously if she’s eyeballing interest rates, buddy. She loves the thought of you two having control of your money. Use this momentum to work together as a team, and knock out that debt!

— Dave

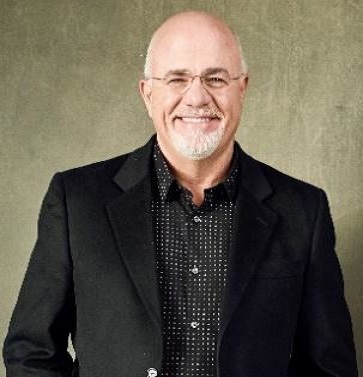

* Dave Ramsey is an eight-time national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)