Dear Dave,

I just discovered you and your teachings a couple of weeks ago. I’m already on Baby Step 2, and I was wondering if I should buy life insurance now or wait until I’ve finished paying off debt. I’m single with no children, and I owe a total of $44,700. I have a $25,000 company-funded life insurance policy through my employer. What do you think I should do?

— Elizabeth

Dear Elizabeth,

If you have a life insurance need, it’s not a Baby Step. It’s a necessity in your budget and something you need to put in place as soon as possible. But from what you’ve told me, you don’t have a great need for life insurance at this point. No one, except you, is depending on your income, and the $25,000 policy you have through your employer is more than enough to take care of any final expenses if something happened to you.

The main purpose of life insurance is to take care of those you leave behind when you die. If someone is financially dependent on your income, I recommend having 10 to 12 times your annual income wrapped up in a good level term life insurance policy. That means if you make $80,000 a year, you should have a policy worth anywhere from $800,000 to $960,000.

If I were you, I wouldn’t buy another life insurance policy at all right now. If you get married or have kids somewhere down the road, then buy it immediately. In that case, both you and your spouse should have 15- to 20-year level term policies of 10 to 12 times your individual incomes.

And never buy anything except level term life insurance. The reason? That covers you until you’re out of debt—should a spouse bring some into the picture—and the two of you have so much cash piled up that you don’t need to pay for a life insurance policy anymore. It’s called being self-insured, and that’s a great place to be.

Good question, Elizabeth!

— Dave

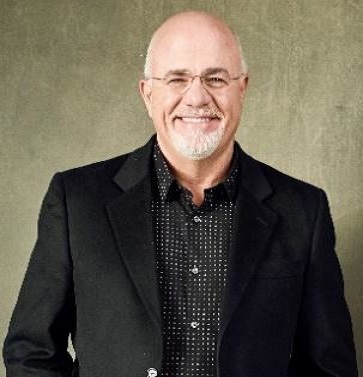

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)