Dear Dave,

Earlier this month, my husband and I both were laid off from our jobs within a few days of each other. The layoffs were not our fault. The company is letting several people go as a cost-cutting measure. We cashed in an annuity because our finances have been tight, but the good news is he began training for a new job last week. We don’t have children, so I am interviewing or filling out applications every day. Should we use the cash from the annuity to live on until things are stable again, or should we use it to pay off debt?

Anjanette

Dear Anjanette,

If you haven’t done so already, contact your creditors and explain what happened. Let them know the layoffs weren’t because either of you did anything wrong, and that you’ll get current with them as soon as possible. This is a scary situation you’re facing, so make sure you two keep the lines of communication wide open and encourage each other while you’re solving this problem.

The good news, though, is it sounds like things may be looking up. Support your husband all you can as he takes on his new job, and make sure you continue looking for work, too. A little extra money never hurts, so temporarily taking on a part-time gig while you’re looking for a permanent position isn’t a bad idea, either.

Of course, you need to be honorable and pay your debts if possible. But that may have to be put on hold for a while. Right now, the important thing is keeping food in the house and the lights and heat on. Hug on each other, stay determined and keep each other’s spirits up. You’re a team, and you’ll get through this.

Always remember, too, that prayer’s a good thing.

— Dave

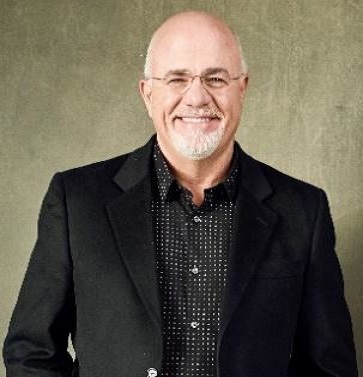

* Dave Ramsey is an eight-time national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)