Dear Dave,

About a year ago, my husband and I offered an empty house we own to a young man at our church, who had lost his home and everything he owned in a fire. He has taken good care of the place, but has made no effort to pay rent. We don’t need the money, because we’re in good shape financially, and we were thinking about selling the other house, anyway. I’d like to simply write it off, and gift the home and title to this young man, but my husband feels he owes us something for putting a roof over his head all this time. What are your thoughts?

Penny

Dear Penny,

I think you and your husband have good hearts. I also think you handled this situation poorly.

From the sound of things, you put him there originally on a charity basis, and now your husband wants to change the deal. You didn’t set up any kind of rental agreement, but your husband feels you two are owed something? I’m sorry, but no. That’s on you.

At this point, you have some big decisions to make. Were you providing free housing to someone who was struggling, or were you providing a free house to someone who was struggling? I understand this young man experienced a terrible tragedy. But at the same time, I’m not hearing lots of evidence that he’s putting his life back together. If after this long the guy’s not back on his feet and out on his own, you may be enabling bad behavior on his part.

Now, if you want to gift him the house, that’s your decision. If you want to approach him with a rental agreement or sale proposal to which all parties are amicable, that’s okay, too. If neither of these ideas are in the cards, I’d make sure to sit down with this young man and have a gentle—but firm—talk. I’d let him know I had been happy to help him over the last several months, but that he needs to start moving forward with his life. I’d set a very reasonable and patient timeline for a move-out date, and let him know once that time is up, I’ll be selling the house.

That’s fair to everyone concerned.

— Dave

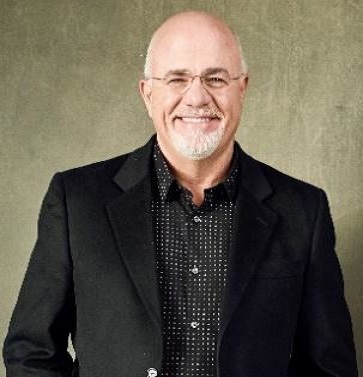

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)