Dear Dave,

My best friend is having financial problems, and I’m worried about him. He’s “between jobs” now and making less than $600 a month through a part-time job. He says he’s holding out for his dream job, which is about ten hours away, but even when he’s working full time, he always asks to borrow money or says he’s running low. He interviewed for his dream job several months ago, and I haven’t got the heart to tell him he was probably passed over for the position. Is there anything I can do to help him?

Garrett

Dear Garett,

I assume that since you’re good friends, he’s willing to listen to what you have to say. There’s absolutely nothing wrong with having a dream job. You just have to be practical and realistic at the same time.

This next part is more observation than insult, so I hope you’ll understand. Your friend sounds to me like he might be a little impulsive and unrealistic. When it comes right down to it, maybe a touch immature, too. So, I think what we’re talking about here is how to give your friend a gentle, well-intentioned nudge in a more realistic direction. He needs to open his eyes to some positive financial realities of life—like living on a written, monthly budget—and not making a habit of chasing rainbows and making excuses.

If he came to me for advice, the first thing I’d tell him is that the most employable people are ones who aren’t broke. When you go into a job interview and you’re broke, it’s easy to come off as desperate and tense. That doesn’t make for a very good interview.

The answer to that, when you’re essentially unemployed, is to work any legitimate full-time job. At the very least, two, three or even four part-time jobs. Deliver pizzas, wait tables and mow yards. It’s doesn’t matter what you’re doing, as long as you’re generating a livable income for yourself. Smile and be professional at whatever you’re doing, too. You never know when you might come face-to-face with your next real employer. But none of this will happen if you’re working three or four hours a day, and spending most of your time at home in front of the television.

I hope this helps. I hope your friend will listen to you and understand you have his best interests at heart. But if he doesn’t, all you can do is hope for the best and pray for him.

Best of luck, Garrett. You’re a good friend.

—Dave

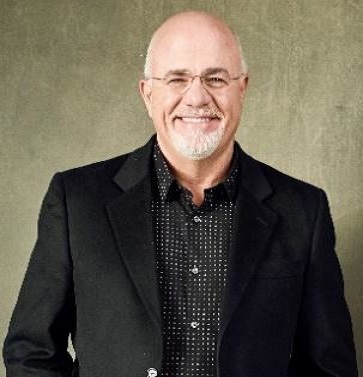

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)