Dear Dave,

How do you know if a will or a trust is best for you?

Monica

Dear Monica,

This is a great question, especially since August is National Make-a-Will Month. The first thing you should do is take a serious look at your needs, your wishes and your overall life and financial circumstances.

If you’re like the average person with a couple of kids, a home and some savings, a will is all you need. There’s no reason to bring lawyers into the mix, unless there’s something complicated about your situation. In cases like this, you can even set one up online that’s perfectly legal in just a few minutes.

If you’re older, your kids are grown and your estate is worth $1 million or more, a trust is the way to go. By doing this, you can avoid probate in a way that wills don’t allow. Now, if you have a large estate and dependents, having both a will and a trust is a good idea. And you don’t have to worry about the two bumping into each other. They’re separate legal instruments, and there’s generally no conflict between them. If there is a legitimate, legal conflict between them, the trust usually overrides the will.

Simply put, everyone needs a will. But not everyone needs a trust. Trusts can be more than you need, but they can also be a great tool if you have a larger estate. So, if you’re in the vast majority of folks who don’t need a trust, just get yourself a will. You’ll spend a lot less money and feel so much better knowing your stuff will go to the right people—and that your family will be taken care of!

— Dave

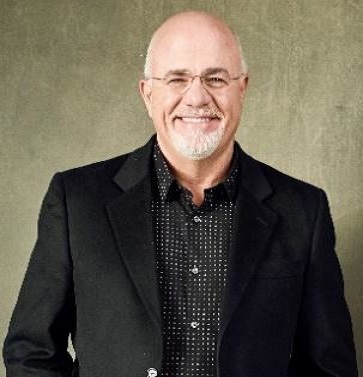

* Dave Ramsey is an eight-time national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)